How to obtain suitable travel insurance

Obtaining suitable travel insurance is a crucial step to ensure peace of mind and comprehensive protection during your journey. First and foremost, you need to assess your insurance needs, such as medical coverage, baggage loss, and trip cancellation. You can search for accredited insurance companies online or seek assistance from insurance agents to help you choose a suitable plan. It is important to carefully read the terms and conditions to ensure the required coverage and avoid surprises. Comparing prices and services offered by different insurance companies is also recommended to ensure you get the best value possible. Suitable travel insurance provides you with reassurance during your trip and protects you from any unexpected incidents that may diminish your travel enjoyment.

To obtain suitable travel insurance, you must first carefully identify your needs, such as medical coverage, baggage insurance, and protection against trip cancellation. You can easily search online for a variety of accredited insurance companies that offer diverse services. Read the terms and details of the available plans to ensure comprehensive coverage and understand the full extent of protection. It is also advisable to consider user reviews and opinions about their experiences with these companies. Compare the options in terms of cost and coverage to choose the insurance that best meets your expectations. After making a decision, don't forget to keep a copy of the insurance documents and have them with you during the trip to be prepared for any emergencies. Thus, you can enjoy your trip with peace of mind and confidence in comprehensive insurance that fully meets your needs.

Crucial Steps in Choosing the Right Travel Insurance

Choosing the right travel insurance is a crucial step in ensuring that you have adequate coverage and protection during your travels. Here are detailed steps to help you make an informed decision when selecting travel insurance:

1. Assess Your Travel Needs:

- Destination and Duration: Consider the destination of your trip and its duration. Some regions may have higher medical costs, and longer trips may require more comprehensive coverage.

- Type of Travel: Different types of travel, such as business trips, adventure travel, or family vacations, may require specific coverage. Identify the specific needs of your trip.

2. Coverage Types:

- Medical Coverage: Ensure that the insurance provides sufficient coverage for medical emergencies, including hospitalization, medical evacuation, and repatriation.

- Trip Cancellation/Interruption: Look for coverage that reimburses non-refundable expenses if your trip is canceled or interrupted due to unforeseen circumstances like illness, natural disasters, or job loss.

- Baggage and Personal Belongings: Check coverage for lost, stolen, or damaged baggage and personal items. Ensure the limits meet the value of your belongings.

- Travel Delays: Consider coverage for travel delays or missed connections, providing reimbursement for additional expenses incurred.

3. Policy Exclusions and Limitations:

- Read the Fine Print: Carefully read the policy exclusions and limitations. Be aware of any conditions that may invalidate your coverage, such as pre-existing medical conditions or engaging in high-risk activities.

- Understanding Exclusions: Ensure you understand what is not covered, as this can be as important as knowing what is covered. Clarify any ambiguities with the insurance provider.

4. Compare Plans:

- Multiple Quotes: Obtain quotes from multiple insurance providers. Compare coverage, limits, deductibles, and premiums to find the best value for your needs.

- Online Reviews: Research customer reviews and testimonials to gauge the experiences of other travelers with a particular insurance provider. This can provide insights into the company's customer service and claim settlement process.

5. Check Provider's Reputation:

- Financial Stability: Choose a reputable insurance provider with a strong financial standing. This ensures their ability to fulfill claims, especially in the case of significant events.

- Customer Service: Consider the quality of customer service. A responsive and helpful customer service team can be crucial during emergencies or when filing a claim.

6. Policy Flexibility and Customization:

- Customizable Policies: Look for insurance providers that allow you to customize your policy to fit your specific needs. This ensures that you pay for the coverage that matters most to you.

- Policy Flexibility: Choose a policy that allows for changes in travel dates or extensions if your plans evolve.

7. Review COVID-19 Coverage:

- Pandemic Coverage: Given the global impact of the COVID-19 pandemic, ensure that your policy covers pandemic-related issues, such as trip cancellations due to COVID-19, medical expenses, and quarantine-related costs.

8. Claim Procedures:

- Understand the Process: Familiarize yourself with the claim procedures. Know how to contact the insurance provider in case of an emergency and understand the documentation required for filing a claim.

9. Consult with a Professional:

- Insurance Advisor: If you're uncertain about which policy suits you best, consider consulting with an insurance advisor. They can provide personalized guidance based on your specific travel plans and needs.

10. Review and Renew:

- Periodic Review: Regularly review your travel insurance needs, especially if your travel habits or circumstances change. Update your coverage accordingly.

- Renewal Considerations: When renewing your policy, assess if there have been any changes in coverage, terms, or conditions. Consider switching providers if a better option is available.

By following these steps and conducting thorough research, you can choose a travel insurance policy that aligns with your specific needs, providing peace of mind during your journeys.

How to Identify Your Needs and Select the Optimal Insurance Coverage

Identifying your needs and selecting the optimal insurance coverage is a crucial process to ensure that you are adequately protected in various aspects of your life. Whether it's health insurance, auto insurance, life insurance, or any other type of coverage, the following steps will guide you in understanding your needs and making informed decisions:

1. Assess Your Current Situation:

-

Evaluate Your Lifestyle: Consider your current lifestyle, family situation, and financial status. Your insurance needs will differ based on factors such as whether you're single or have a family, your income level, and your overall health.

-

Review Existing Coverage: If you already have insurance policies, review the coverage and assess whether it still meets your needs. Life changes, such as marriage, the birth of a child, or a change in employment, may necessitate adjustments to your coverage.

2. Identify Potential Risks:

-

Evaluate Risks in Different Areas: Assess potential risks in various aspects of your life, including health, property, income, and liabilities. Consider what risks you would face in worst-case scenarios.

-

Consider Your Profession: Depending on your profession, there may be specific risks associated with your work. Professionals in high-liability fields may need additional liability coverage.

3. Understand Types of Insurance:

-

Research Different Types of Insurance: Familiarize yourself with various types of insurance such as health, life, auto, home, and liability insurance. Understand what each type covers and its relevance to your situation.

-

Recognize Legal Requirements: Some types of insurance, like auto insurance, may be legally required. Ensure compliance with legal obligations while assessing your needs.

4. Determine Coverage Limits:

-

Assess Financial Exposure: Consider the potential financial impact of different risks. Assess how much coverage you would need to protect yourself financially in case of an unfortunate event.

-

Balancing Act: Strive for a balance between adequate coverage and affordable premiums. Avoid underinsurance, which could leave you exposed to significant financial burdens.

5. Consider Your Health Needs:

-

Evaluate Health Conditions: Assess your current health and potential future health needs. This is crucial for selecting the right health insurance coverage, including coverage for pre-existing conditions.

-

Anticipate Future Changes: Consider any expected changes in your health, such as planned surgeries or family planning, and ensure your health insurance accommodates these.

6. Evaluate Your Dependents:

-

Consider Family Needs: If you have dependents, assess their needs. This includes education expenses, housing, and overall financial support. Life insurance can be crucial to provide for your family in case of your untimely death.

-

Plan for Education: If you have children, consider insurance policies that can help fund their education in case of unforeseen circumstances.

7. Compare Insurance Providers:

-

Get Multiple Quotes: Obtain quotes from different insurance providers. Compare coverage, premiums, customer reviews, and the reputation of the insurance companies.

-

Check Claim Settlement Record: Investigate the claim settlement process and history of each provider. A reputable company should have a reliable track record in settling claims efficiently.

8. Consult with an Insurance Advisor:

- Professional Guidance: If navigating insurance options is overwhelming, consider consulting with an insurance advisor. They can provide personalized advice based on your specific needs and help you understand complex policies.

9. Review and Update Regularly:

-

Periodic Reviews: Regularly review your insurance coverage, especially when significant life events occur. Adjust coverage as needed to reflect changes in your circumstances.

-

Update Policies: If there are changes in your life, such as marriage, the birth of a child, or a major purchase, update your policies accordingly.

10. Read Policy Terms Carefully:

-

Understanding Terms and Conditions: Before finalizing any insurance policy, carefully read and understand the terms and conditions. Pay attention to exclusions, deductibles, and any limitations that may affect your coverage.

-

Ask Questions: If there are aspects of the policy you don't understand, don't hesitate to ask questions. Clarify any ambiguities with the insurance provider or your insurance agent.

In conclusion, identifying your needs and selecting the optimal insurance coverage requires a thoughtful and thorough approach. By considering your current situation, potential risks, and understanding the types of insurance available, you can make informed decisions that provide the necessary protection for you and your loved ones. Regular reviews and updates ensure that your coverage remains aligned with your evolving needs. If in doubt, seek professional advice to make sure you have the right coverage in place.

Top Companies for Travel Insurance

Selecting the right travel insurance is crucial to ensure you have adequate coverage and peace of mind during your travels. There are several travel insurance companies in the market, each offering different plans with various features. To help consumers make informed decisions, here's a consumer's guide to some of the top companies for travel insurance:

1. Allianz Global Assistance:

- Overview: Allianz is a well-established global insurance company with a strong reputation in the travel insurance sector.

- Key Features:

- Comprehensive coverage for trip cancellations, interruptions, and delays.

- Emergency medical coverage, including evacuation and repatriation.

- Options for single-trip and annual multi-trip policies.

2. World Nomads:

- Overview: World Nomads caters to travelers seeking adventure and exploration, offering specialized coverage for various activities.

- Key Features:

- Coverage for a range of adventure activities like hiking, scuba diving, and more.

- Flexible and customizable plans for different travel needs.

- 24/7 emergency assistance services.

3. Travelex Insurance Services:

- Overview: Travelex is a well-known travel insurance provider offering a variety of plans for different types of travelers.

- Key Features:

- Trip cancellation and interruption coverage.

- Optional upgrades for cancel for any reason (CFAR) coverage.

- Coverage for lost, stolen, or damaged baggage.

4. Generali Global Assistance:

- Overview: Generali provides a range of travel insurance plans, including options for families and frequent travelers.

- Key Features:

- Coverage for trip cancellations, interruptions, and delays.

- Emergency medical and dental coverage.

- 24/7 assistance services.

5. AXA Assistance USA:

- Overview: AXA is a global insurance provider with a strong presence in travel insurance, offering comprehensive coverage options.

- Key Features:

- Coverage for trip cancellations, delays, and interruptions.

- Medical coverage, including emergency medical expenses and evacuation.

- Optional coverage for adventure activities.

6. John Hancock Insurance Agency:

- Overview: John Hancock provides travel insurance with a focus on offering coverage for unexpected events.

- Key Features:

- Trip cancellation and interruption coverage.

- Pre-existing medical condition coverage available.

- 24/7 assistance services.

7. InsureMyTrip:

- Overview: InsureMyTrip is an online marketplace that allows users to compare and purchase travel insurance plans from various providers.

- Key Features:

- Comparison tool for finding the best-suited plan based on individual needs.

- Customer reviews and ratings for various insurance providers.

- Access to a wide range of plans from different companies.

8. Seven Corners:

- Overview: Seven Corners offers a variety of travel insurance plans, including options for international travelers, students, and expatriates.

- Key Features:

- Coverage for trip cancellations, interruptions, and delays.

- Medical coverage with customizable limits.

- Optional coverage for high-risk activities.

9. Travel Guard (AIG):

- Overview: AIG's Travel Guard provides a range of travel insurance plans with varying coverage levels to meet different travel needs.

- Key Features:

- Trip cancellation and interruption coverage.

- Comprehensive medical coverage.

- 24/7 travel assistance services.

10. Squaremouth:

- Overview: Squaremouth is another online platform that allows consumers to compare travel insurance plans from different providers.

- Key Features:

- Transparent comparison tools for finding the best plans.

- Customer reviews and ratings for insurance providers.

- Access to a diverse range of plans based on individual preferences.

Tips for Choosing the Right Travel Insurance Company:

- Compare Plans: Consider using online comparison tools to evaluate plans from different companies based on your specific needs.

- Read Reviews: Look for customer reviews and ratings to get insights into the experiences of other travelers with a particular insurance provider.

- Check Coverage Limits: Ensure that the coverage limits meet your requirements, especially for medical expenses, trip cancellations, and lost baggage.

- Understand Exclusions: Pay attention to the exclusions and limitations of the policy to avoid surprises during a claim.

- Consider Your Activities: If you plan on engaging in adventure activities, make sure the insurance policy covers these activities adequately.

- Check Customer Service: Evaluate the customer service reputation of the insurance company, especially their responsiveness during emergencies.

Choosing the right travel insurance company involves thorough research and consideration of your specific needs. By understanding the features offered by different providers and comparing plans, you can select a travel insurance policy that provides the necessary coverage for a worry-free journey.

Benefits of Travel Insurance and How It Protects You During Your Journey

Travel insurance is a crucial aspect of trip planning that provides financial protection and assistance in various unforeseen circumstances. Understanding the benefits of travel insurance and how it protects you during your journey is essential for ensuring a safe and worry-free travel experience.

1. Trip Cancellation and Interruption:

- Benefit: Travel insurance covers trip cancellation or interruption due to unforeseen events, such as illness, injury, or death of a traveler or a family member.

- Protection: If you need to cancel or cut short your trip for a covered reason, travel insurance helps recover non-refundable expenses like flights, accommodations, and tours.

2. Emergency Medical Expenses:

- Benefit: Travel insurance provides coverage for emergency medical expenses incurred during your trip, including hospital stays, surgeries, and medication costs.

- Protection: This benefit ensures you receive necessary medical treatment without facing exorbitant out-of-pocket expenses, especially when traveling to destinations with high healthcare costs.

3. Trip Delay and Missed Connection:

- Benefit: Compensation for additional expenses due to trip delays or missed connections, such as accommodation, meals, and transportation costs.

- Protection: Travel insurance helps alleviate the financial burden caused by unexpected delays, ensuring you have the means to continue your journey smoothly.

4. Lost, Stolen, or Delayed Baggage:

- Benefit: Reimbursement for lost, stolen, or delayed baggage, covering the cost of essential items during the waiting period.

- Protection: In the event of lost luggage, travel insurance ensures you can replace necessary belongings, making your travel experience less stressful.

5. Emergency Evacuation and Repatriation:

- Benefit: Coverage for emergency evacuation to the nearest suitable medical facility or repatriation to your home country in the case of a serious illness or injury.

- Protection: Travel insurance provides financial support for the substantial costs associated with medical evacuations, ensuring you receive appropriate medical care.

6. Cancellation for Any Reason (CFAR):

- Benefit: Optional coverage that allows cancellation for any reason not otherwise covered by the standard policy.

- Protection: CFAR provides flexibility and allows travelers to cancel their trip for reasons that may not fall under typical covered events, offering an extra layer of assurance.

7. Personal Liability and Legal Expenses:

- Benefit: Coverage for legal expenses and personal liability in case you accidentally cause injury or damage to property during your trip.

- Protection: Travel insurance shields you from potential legal costs and liabilities, offering financial assistance in case of legal disputes.

8. 24/7 Assistance Services:

- Benefit: Access to 24/7 emergency assistance services, including medical consultations, travel arrangements, and support in unforeseen situations.

- Protection: Travel insurance provides a lifeline in emergencies, ensuring you can reach out for help and guidance at any time during your journey.

9. Coverage for Adventure Activities:

- Benefit: Some travel insurance plans offer coverage for adventurous activities, such as skiing, scuba diving, or hiking.

- Protection: If you plan to engage in high-risk activities, having coverage ensures that you are financially protected in case of accidents or emergencies related to these activities.

10. Peace of Mind:

- Benefit: Perhaps the most significant benefit of travel insurance is the peace of mind it offers.

- Protection: Knowing that you have financial protection and assistance in various scenarios allows you to enjoy your trip without constant worry about unforeseen circumstances.

In conclusion, travel insurance is a valuable investment that provides comprehensive protection, ensuring you are financially covered in case of unexpected events during your journey. The benefits extend beyond financial reimbursement, offering peace of mind and assistance services that contribute to a safer and more enjoyable travel experience.

Comparing Prices and Services to Choose the Best Insurance for Your Trip

Choosing the best insurance for your trip involves a thorough comparison of prices and services offered by various insurance providers. This process ensures that you not only get the most cost-effective coverage but also the specific services that meet your travel needs. Here's a detailed guide on how to compare prices and services to choose the best insurance for your trip:

1. Define Your Needs:

- Before comparing prices, identify your specific needs:

- Consider the type and duration of your trip.

- Assess potential risks such as medical emergencies, trip cancellations, or lost baggage.

- Determine if you need coverage for adventure activities or special circumstances.

2. Compare Coverage Limits:

- Examine the coverage limits for key aspects:

- Medical Coverage: Check the maximum coverage for emergency medical expenses.

- Trip Cancellation: Understand the limits for trip cancellation and interruption coverage.

- Baggage Loss or Delay: Review coverage limits for lost, stolen, or delayed baggage.

3. Understand Deductibles and Exclusions:

- Deductibles: Evaluate the deductibles associated with different coverage types. A deductible is the amount you pay before the insurance kicks in.

- Exclusions: Carefully read the policy to understand exclusions—situations or events not covered by the insurance.

4. Compare Premiums:

- Obtain quotes from multiple providers:

- Use online tools or contact insurance companies directly for quotes.

- Consider annual travel insurance plans if you're a frequent traveler.

- Compare premiums for single-trip policies based on your travel details.

5. Check Policy Flexibility:

- Cancellation Policies: Understand the terms for canceling or modifying your policy.

- Policy Upgrades: Check if there are options to upgrade your policy during the trip if needed.

- Extensions: Determine if you can extend your coverage if your trip is longer than initially planned.

6. Review Customer Reviews and Ratings:

- Online Reviews: Read customer reviews on independent review sites.

- Company Ratings: Check the financial stability and customer service ratings of insurance companies.

7. Assess Emergency Assistance Services:

- 24/7 Assistance: Ensure the insurance provider offers 24/7 emergency assistance services.

- Medical Consultations: Check if they provide access to medical professionals for consultations.

8. Evaluate Claim Processes:

- Claims Handling: Research the ease and efficiency of the claims process.

- Customer Experiences: Look for feedback from travelers who have filed claims with the insurance provider.

9. Consider Additional Benefits:

- Additional Coverage: Some policies offer extra benefits like coverage for missed connections, identity theft, or rental car damage.

- Pre-Existing Conditions: Check if pre-existing medical conditions are covered or if there's an option to add such coverage.

10. Check for Discounts and Special Offers:

- Group Discounts: Inquire about discounts for group or family policies.

- Special Offers: Look for promotions or special offers provided by insurance companies.

11. Read the Fine Print:

- Policy Details: Thoroughly read the policy documents to understand all terms and conditions.

- Ask Questions: Clarify any doubts by reaching out to the insurance provider directly.

12. Consider Reputation and Financial Stability:

- Company Reputation: Choose insurance providers with a good reputation for reliability and customer satisfaction.

- Financial Stability: Assess the financial stability of the company to ensure they can fulfill their commitments.

13. Consult with Travel Agents or Experts:

- Professional Advice: Seek advice from travel agents or insurance experts who can guide you based on your specific travel plans.

- Policy Recommendations: They may provide insights into which policies align best with your needs.

14. Make an Informed Decision:

- Balance Coverage and Cost: Strike a balance between the coverage offered and the cost of the insurance.

- Peace of Mind: Choose a policy that gives you peace of mind and aligns with your comfort level regarding risk.

By diligently comparing prices and services using these steps, you can make an informed decision and select the best travel insurance for your specific trip. Remember that the right insurance adds a layer of security, allowing you to enjoy your journey with confidence.

Strategies to Cut Travel Insurance Costs Without Sacrificing Coverage

Reducing travel insurance costs without compromising coverage is a smart approach to ensure financial protection during your trips. Here are strategies to cut travel insurance costs without sacrificing coverage:

1. Shop Around for Competitive Quotes:

- Compare Multiple Providers: Obtain quotes from various insurance providers. Use online comparison tools or consult with insurance agents to find competitive rates.

- Consider Annual Plans: If you travel frequently, explore annual travel insurance plans, which might be more cost-effective than purchasing separate policies for each trip.

2. Adjust Coverage Based on Needs:

- Customize Your Policy: Tailor your coverage to fit your specific needs. For example, if your health insurance already provides international coverage, you may not need extensive medical coverage in your travel insurance.

- Choose Relevant Options: Select coverage options that align with your travel plans. Avoid unnecessary add-ons that may increase costs without providing significant benefits.

3. Opt for Higher Deductibles:

- Choose Higher Deductibles: A deductible is the amount you pay before the insurance kicks in. Opting for a higher deductible can lower your premium costs. Ensure the chosen deductible is affordable for you in case you need to make a claim.

4. Bundle Insurance Policies:

- Bundle with Other Policies: Inquire if your insurance provider offers discounts for bundling travel insurance with other policies, such as auto or home insurance.

- Group or Family Discounts: If traveling with a group or family, check for group discounts offered by insurance companies.

5. Check for Discounts and Promotions:

- Look for Promotions: Keep an eye out for promotions, discounts, or special offers provided by insurance companies during specific periods.

- Affiliation Discounts: Some insurers offer discounts for members of certain organizations or loyalty programs.

6. Review and Eliminate Duplicate Coverage:

- Evaluate Existing Coverage: Review your existing insurance policies, including health and credit card coverages, to avoid duplicate coverage. Adjust your travel insurance accordingly.

- Exclude Redundant Coverage: Exclude coverage items that are already provided by other insurance policies to prevent unnecessary expenses.

7. Consider a Cancel-for-Any-Reason (CFAR) Option:

- Evaluate CFAR Coverage: Assess the value of adding a Cancel-for-Any-Reason option. While it may increase the premium slightly, it offers flexibility in canceling for non-traditional reasons.

- Determine Suitability: If you anticipate potential disruptions, the CFAR option may be worth the additional cost.

8. Maintain Good Health Practices:

- Stay Healthy: Maintain good health practices to reduce the likelihood of medical emergencies during your trip.

- Preventive Measures: Adhering to preventive measures can minimize the need for extensive medical coverage.

9. Review Trip Cancellation Policies:

- Understand Cancellation Policies: Familiarize yourself with the cancellation policies of airlines, accommodations, and other travel-related services. This can influence the type and extent of trip cancellation coverage you need.

- Optimize Coverage: Adjust trip cancellation coverage based on the refund policies of your booked services.

10. Consider Geographic Coverage Limits:

- Limit Geographic Coverage: If your travel plans exclude certain regions, consider opting for a policy with geographic coverage limits. This can lower costs as you're not paying for unnecessary coverage.

11. Review and Update Coverage Regularly:

- Regularly Assess Coverage: Periodically review your travel insurance needs, especially if your travel patterns or health conditions change.

- Update Accordingly: Make adjustments to your coverage based on changes in your circumstances to ensure cost-effectiveness.

12. Seek Professional Advice:

- Consult with Insurance Experts: Seek advice from insurance professionals or travel agents who can guide you on cost-effective yet comprehensive coverage.

- Policy Recommendations: They may provide insights into which policies align best with your needs and budget.

13. Maintain a Good Travel Record:

- Travel Responsibly: Avoid risky behaviors that may result in claims, such as extreme sports or reckless activities.

- Good Travel History: Demonstrating a history of responsible travel behavior can potentially lead to lower premiums over time.

14. Review and Understand Policy Terms:

- Thoroughly Read Terms and Conditions: Understand the terms and conditions of your policy to ensure you are aware of coverage limitations, exclusions, and claim procedures.

- Ask Questions: If there are unclear points, reach out to the insurance provider for clarification before finalizing the policy.

By implementing these strategies, you can effectively reduce travel insurance costs while maintaining adequate coverage, ensuring that you are financially protected during your journeys.

Analyzing Insurance Terms and Conditions

Analyzing insurance terms and conditions is a crucial step in understanding the specifics of your insurance coverage. These terms and conditions outline the rights, responsibilities, limitations, and exclusions associated with your insurance policy. Here's what you need to know when delving into the intricate details of insurance terms and conditions:

1. Policy Definitions:

- Understand Key Terms: Begin by familiarizing yourself with key terms used in the policy. Definitions can vary between insurance providers, so make sure you understand how specific terms are defined in your policy.

- Clarity is Key: Clear definitions help avoid misunderstandings later on. If any term is unclear, consult the insurance provider or seek professional advice.

2. Coverage Details:

- Scope of Coverage: Clearly understand what is covered under the policy. This includes the types of risks, events, or situations that the insurance provider will compensate for.

- Limitations and Exclusions: Identify any limitations or exclusions to coverage. Policies often have specific scenarios or circumstances that are not covered, and being aware of these is crucial.

3. Policy Limits and Deductibles:

- Coverage Limits: Know the maximum amount the insurance provider will pay for a covered loss. This is often specified for different categories like medical expenses, trip cancellations, or baggage loss.

- Deductibles: Understand the deductible amount, which is the portion of the claim you must pay out of pocket before the insurance coverage kicks in.

4. Claims Process:

- Reporting Procedures: Familiarize yourself with the procedures for reporting and filing a claim. Understand the timelines and documentation required when initiating a claim.

- Contact Information: Keep contact information for the insurance provider and any emergency assistance services readily accessible.

5. Exclusions and Limitations:

- Identify Excluded Items: Know what items, situations, or events are explicitly excluded from coverage. Common exclusions may include pre-existing medical conditions, extreme sports, or certain high-risk activities.

- Coverage Restrictions: Be aware of any restrictions on coverage, such as geographical limitations or specific conditions that must be met for coverage to apply.

6. Policy Renewal and Cancellation:

- Renewal Terms: Understand the terms for policy renewal, including any changes in coverage, premiums, or conditions. Some policies may have automatic renewals unless canceled.

- Cancellation Policies: Know the conditions under which you or the insurance provider can cancel the policy. Understand any fees or penalties associated with cancellations.

7. Terms for Pre-Existing Conditions:

- Pre-Existing Conditions: If you have pre-existing medical conditions, carefully review how they are addressed in the policy. Some policies may exclude coverage for certain conditions, while others may offer coverage with specific conditions.

8. Emergency Assistance Services:

- Services Provided: Understand the extent of emergency assistance services provided by the insurance company. This may include medical assistance, travel assistance, or legal support in case of emergencies.

- Availability and Accessibility: Ensure that emergency assistance services are available 24/7 and that you have the necessary contact information.

9. Responsibilities of the Insured:

- Policyholder Responsibilities: Be aware of your responsibilities as the policyholder. This may include timely reporting of incidents, cooperation during the claims process, and compliance with policy terms.

- Obligations During Travel: Understand any obligations or requirements while traveling, such as following safety guidelines or taking precautions to prevent loss.

10. Reviewing Updates and Amendments:

- Stay Informed: Keep yourself informed about any updates or amendments to the policy terms and conditions. Insurance providers may make changes, and it's essential to stay current with the latest information.

11. Understanding Sub-Limits:

- Sub-Limits for Specific Categories: Some policies may have sub-limits, specifying the maximum amount payable for certain categories within the overall coverage. Pay attention to these details, especially if you have specific concerns like expensive items or activities.

12. Cancellation and Interruption Coverage:

- Specific Events Covered: If your policy includes trip cancellation or interruption coverage, understand the specific events that are covered. This can range from illness or injury to unforeseen emergencies or natural disasters.

13. Policy Expiry and Renewal Notices:

- Receive Notifications: If available, opt to receive policy expiry and renewal notices from the insurance provider. This helps you stay informed and take appropriate actions well in advance.

14. Professional Advice:

- Consult with Experts: If you find certain terms confusing or have specific concerns, consider seeking professional advice. Insurance brokers or legal experts can provide clarity and ensure you fully understand the terms and conditions.

15. Language and Interpretation:

- Legal Language: Policies often use legal and technical language. If needed, seek clarification on any terms or phrases to ensure accurate interpretation.

- Inconsistencies: Look for any inconsistencies or ambiguous terms. Seek clarification from the insurance provider to avoid potential misunderstandings.

Analyzing insurance terms and conditions is a critical aspect of responsible insurance ownership. Taking the time to understand the specifics of your policy ensures that you are well-informed, can make informed decisions, and are adequately covered in case of unforeseen events. If in doubt, seek professional advice to ensure a clear understanding of your insurance coverage.

Tips for Getting Affordable and Effective Travel Insurance

Obtaining affordable and effective travel insurance is crucial for ensuring financial protection during your trips. Here are some tips to help you find travel insurance that is both cost-effective and provides comprehensive coverage:

1. Start Early:

- Plan Ahead: Begin your search for travel insurance well in advance of your trip. This allows you to explore various options and find the best deals without feeling rushed.

2. Understand Your Needs:

- Assess Your Travel Plans: Analyze the specifics of your trip, including destination, duration, and activities planned. Different trips may require different types of coverage, so understanding your needs is key.

3. Compare Policies:

- Shop Around: Don't settle for the first insurance policy you come across. Compare policies from different providers to understand the range of coverage options and prices available.

4. Choose the Right Coverage:

- Tailor Coverage to Your Needs: Select a policy that aligns with your specific needs. If you're engaging in adventure sports, make sure those activities are covered. If you have pre-existing medical conditions, choose a policy that provides adequate coverage for them.

5. Consider Multi-Trip Policies:

- For Frequent Travelers: If you travel frequently, consider multi-trip or annual policies. These can be more cost-effective than purchasing separate policies for each trip.

6. Review Deductibles:

- Understand Deductibles: Be aware of the deductible amount – the portion of a claim you must pay before the insurance coverage kicks in. Higher deductibles may lower your premium but increase your out-of-pocket expenses in case of a claim.

7. Check for Age Limits:

- Age-Specific Policies: Some travel insurance policies may have age restrictions or charge higher premiums for older travelers. Make sure the policy you choose is suitable for your age group.

8. Explore Group Plans:

- Group Discounts: If you're traveling with a group, inquire about group travel insurance plans. Some providers offer discounts for group bookings.

9. Consider Add-Ons Carefully:

- Additional Coverages: While add-ons can enhance your coverage, be selective. Evaluate whether each add-on is essential for your trip or if it's an unnecessary expense.

10. Review Policy Limits:

- Coverage Limits: Understand the maximum amounts the insurance will pay for different categories, such as medical expenses, trip cancellations, or baggage loss. Ensure the limits meet your needs.

11. Check for Exclusions:

- Be Aware of Exclusions: Carefully read and understand the exclusions in the policy. Certain activities, pre-existing conditions, or regions may be excluded from coverage.

12. Opt for Comprehensive Coverage:

- All-in-One Policies: Consider comprehensive coverage that includes medical, trip cancellation, baggage, and other essential components. While it may seem pricier, it can offer better value in the long run.

13. Utilize Travel Insurance Aggregators:

- Comparison Websites: Use travel insurance comparison websites or aggregators to streamline your search. These platforms provide an overview of multiple policies, making it easier to compare.

14. Read Reviews and Ratings:

- Customer Feedback: Look for reviews and ratings of insurance providers. Feedback from other travelers can give you insights into the reliability and customer service of the company.

15. Check for Policy Upgrades:

- Policy Upgrade Options: Some insurance providers offer policy upgrades that may provide additional coverage at a reasonable cost. Inquire about such options.

16. Ask for Discounts:

- Inquire About Discounts: Don't hesitate to ask the insurance provider about available discounts. Some offer discounts for students, seniors, or members of certain organizations.

17. Review the Claim Process:

- Smooth Claim Process: Understand the procedures and documentation required for filing a claim. A streamlined and efficient claims process is crucial for a hassle-free experience in case of emergencies.

18. Consider Cancel-for-Any-Reason (CFAR) Coverage:

- Flexibility in Cancellation: If flexibility in cancellation is important to you, consider CFAR coverage. It allows you to cancel for reasons not covered by standard policies, though it may come at an additional cost.

19. Maintain a Good Travel Record:

- Travel Responsibly: Avoid risky behaviors that could lead to claims, such as extreme sports or reckless activities.

- Good Travel History: Responsible behavior during travel can lead to lower premiums in the long run.

20. Regularly Review and Update Coverage:

- Assess Coverage Regularly: Review your insurance needs regularly, especially if your travel patterns or health conditions change.

- Update as Needed: Adjust your coverage based on changes in your circumstances to ensure cost-effective adequacy.

21. Seek Professional Advice:

- Consult Insurance Experts: Seek advice from insurance experts or travel agents who can guide you toward comprehensive and cost-effective coverage.

- Policy Recommendations: They may provide insights into policies that best suit your needs and budget.

Finding affordable and effective travel insurance requires careful consideration of your specific needs, thorough comparison of policies, and awareness of potential discounts and upgrades. By following these tips and staying informed, you can secure insurance that not only fits your budget but also provides comprehensive protection during your journeys.

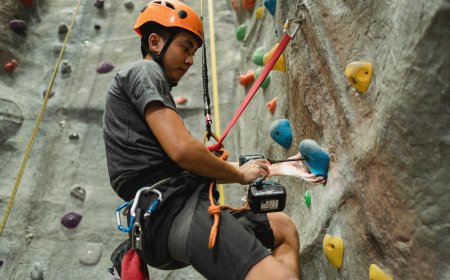

Adventure Travel Insurance

Adventure travel insurance is a specialized form of travel insurance designed for individuals seeking thrill and excitement through adventurous activities. Whether you're planning a hiking expedition, engaging in extreme sports, or embarking on a safari, adventure travel insurance provides coverage tailored to the risks associated with high-adrenaline pursuits. Here are key considerations and recommendations when exploring adventure travel insurance:

Considerations:

-

Activity Coverage:

- Define Your Activities: Clearly identify the adventurous activities you plan to undertake. Different insurance policies may cover varying degrees of risk, so ensure that your chosen activities are explicitly covered.

-

Risk Assessment:

- Evaluate Risks: Assess the level of risk associated with your chosen activities. High-risk sports or activities may require specialized coverage, and the insurance premium may be influenced by the perceived risk level.

-

Medical Coverage:

- Emergency Medical Expenses: Confirm that the policy provides adequate coverage for emergency medical expenses resulting from injuries sustained during adventure activities. This includes evacuation and repatriation in case of serious incidents.

-

Search and Rescue Coverage:

- Helicopter Evacuation: Some adventure activities may involve remote locations. Ensure your policy covers the cost of search and rescue, including helicopter evacuation if necessary.

-

Equipment Coverage:

- Coverage for Gear: If your adventure involves expensive equipment, such as climbing gear or scuba diving equipment, check if the insurance provides coverage for loss, damage, or theft of these items.

-

Trip Cancellation/Interruption:

- Flexible Plans: Adventure travel plans can be affected by unpredictable factors. Look for policies that offer trip cancellation or interruption coverage, providing reimbursement for non-refundable expenses in case of unforeseen circumstances.

-

Pre-Existing Conditions:

- Coverage for Pre-Existing Conditions: If you have pre-existing medical conditions, inquire about coverage for related emergencies during adventure activities. Some policies may exclude pre-existing conditions.

-

Adventure Sports Exclusions:

- Examine Exclusions: Carefully review the policy's exclusions related to adventure sports. Some activities may be excluded, and understanding these exclusions is crucial to avoid surprises during claims.

-

Policy Duration:

- Extended Trips: If your adventure involves an extended trip, ensure that the insurance coverage duration aligns with the entire duration of your journey.

-

Location Coverage:

- Global Coverage: Check if the adventure travel insurance provides coverage globally. Certain regions may have specific risks, and comprehensive coverage should extend to those areas.

Recommendations:

-

Specialized Adventure Policies:

- Consider Specialized Plans: Some insurance providers offer specialized adventure travel insurance plans catering to specific activities. These plans may provide more comprehensive coverage for the associated risks.

-

Insurance Aggregators:

- Use Comparison Platforms: Utilize insurance comparison platforms to explore multiple adventure travel insurance options. These platforms can streamline the process of evaluating policies from different providers.

-

Read Policy Terms:

- Thoroughly Understand Terms: Carefully read and understand the terms and conditions of the policy. Pay attention to coverage limits, exclusions, and any additional requirements specific to adventure activities.

-

Customer Reviews:

- Learn from Others' Experiences: Read customer reviews and testimonials about the insurance provider. Feedback from individuals who have made claims related to adventure activities can offer insights into the reliability of the coverage.

-

Emergency Assistance Services:

- 24/7 Emergency Assistance: Choose a policy that provides 24/7 emergency assistance services. This ensures immediate support in case of emergencies, including medical assistance and evacuation.

-

Claim Process:

- Simplified Claims Process: Evaluate the ease and efficiency of the claims process. A straightforward and user-friendly claims process is crucial, especially in high-stress situations.

-

Coverage for Trip Delays:

- Delays and Interruptions: Look for coverage that includes trip delays or interruptions due to unforeseen circumstances. This can be particularly relevant in adventure travel where plans may change abruptly.

-

Cancellation for Any Reason (CFAR):

- Flexibility in Cancellation: Consider policies that offer "Cancel for Any Reason" (CFAR) coverage. While this may come at an additional cost, it provides flexibility in canceling the trip for reasons not covered by standard policies.

-

Review Policy Updates:

- Stay Informed: Regularly check for updates or modifications to the policy terms. Insurance providers may make changes, and staying informed ensures you have the latest information.

-

Consultation with Experts:

- Seek Professional Advice: If you are uncertain about the coverage or have specific concerns, consult with insurance experts or travel advisors. They can provide personalized advice based on your adventure plans.

- Adventure Travel Communities:

- Engage with Communities: Connect with adventure travel communities or forums to gather insights from fellow enthusiasts. Recommendations from experienced adventurers can guide you in selecting suitable insurance.

In conclusion, adventure travel insurance is a crucial component of planning for high-risk and thrilling activities. By carefully considering the specific needs of your adventure, understanding policy terms, and exploring specialized plans, you can ensure comprehensive coverage and peace of mind during your adrenaline-packed journeys.

Importance of Keeping Insurance Documents and Contacting the Company in Emergencies

The importance of keeping insurance documents and promptly contacting the insurance company in emergencies cannot be overstated. These practices are crucial to ensuring a smooth and effective resolution in case unexpected situations or crises arise during your travels. Here is an in-depth look at why it is essential to maintain your insurance documents and reach out to the company in times of emergencies:

Importance of Keeping Insurance Documents:

-

Verification of Coverage:

- Policy Details: Insurance documents contain vital information about your coverage, including policy limits, terms, and conditions. Keeping these documents handy allows you to verify your coverage details whenever needed.

-

Quick Reference in Emergencies:

- Immediate Access: During emergencies, having your insurance documents readily available facilitates quick reference to important contact numbers, policy numbers, and coverage specifics. This can be crucial when time is of the essence.

-

Meeting Documentation Requirements:

- Travel Authorities and Providers: Some travel authorities and service providers may require proof of insurance. Carrying your insurance documents ensures you can easily comply with any documentation requirements that may arise during your journey.

-

Claims Processing:

- Smooth Claims: In the unfortunate event of a mishap or medical emergency, having your insurance documents expedites the claims process. It provides the necessary information for the insurance company to assess and process your claim efficiently.

-

Policy Renewal and Updates:

- Renewal Process: Insurance documents often include renewal dates and terms. Keeping track of these details helps you stay proactive in renewing your policy on time and making any necessary updates to your coverage.

-

Understanding Exclusions and Limitations:

- Policy Exclusions: Insurance documents outline exclusions and limitations. Being aware of these details helps you understand the circumstances in which coverage may be limited or unavailable, allowing you to plan accordingly.

-

Communication with Healthcare Providers:

- Healthcare Coordination: In case of medical emergencies, having your insurance details readily available enables smoother communication with healthcare providers. It ensures that the necessary arrangements for payment and coverage can be made promptly.

Importance of Contacting the Company in Emergencies:

-

Immediate Assistance:

- Emergency Services: Contacting your insurance company in emergencies allows you to access immediate assistance. They can guide you on the necessary steps to take, including seeking medical help or assistance with travel disruptions.

-

Coordination of Services:

- Medical Coordination: For medical emergencies, your insurance company can assist in coordinating services, such as arranging medical evacuations, providing information to healthcare providers, and ensuring seamless communication.

-

Authorization for Medical Procedures:

- Pre-Approval: Some insurance policies require pre-approval for certain medical procedures. Contacting the company allows you to seek pre-approval, ensuring that necessary medical treatments are covered.

-

Claims Reporting:

- Timely Reporting: In the event of a covered incident, timely reporting to the insurance company is essential for the claims process. This includes providing details of the incident, submitting required documentation, and initiating the claims assessment.

-

Travel Assistance Services:

- Logistical Support: Insurance companies often offer travel assistance services. Contacting them in emergencies can provide logistical support, such as assistance with travel arrangements, accommodation, or repatriation.

-

Legal Assistance:

- Legal Guidance: In certain situations, you may require legal assistance. Contacting your insurance company allows you to seek guidance on legal matters related to your coverage, ensuring that you are well-informed and supported.

-

Communication Channels:

- 24/7 Hotlines: Many insurance companies provide 24/7 hotlines for emergencies. Having access to these hotlines ensures that you can reach the company at any time, regardless of time zone differences.

-

Updates and Alerts:

- Real-time Information: Insurance companies can provide real-time updates and alerts during emergencies, such as natural disasters or geopolitical events. Staying in contact allows you to receive relevant information for your safety and well-being.

In conclusion, keeping your insurance documents organized and contacting the insurance company promptly in emergencies are fundamental practices for travelers. These actions not only streamline the claims process but also ensure that you receive timely assistance and support during unexpected and challenging situations.

In conclusion

the importance of obtaining suitable travel insurance is evident in ensuring a safe and reassuring travel experience. Through assessing your needs and conducting thorough research, you can find the optimal plan that provides comprehensive protection for you and your belongings during the journey. Travel insurance offers peace of mind and security, aiding in effectively dealing with any emergencies that may arise. Do not hesitate to take advantage of the services offered by accredited insurance companies, and always remember to stay informed about the terms of the documents and intricate details to ensure optimal coverage. With these proactive steps, you can enjoy your trip with peace and confidence, knowing that you are covered by insurance that safeguards you at all times.

Sources

What's Your Reaction?