Preventive Measures Strategies: Protecting Your Family from Potential Challenges

Family preventive measures encompass a set of strategies and measures aimed at safeguarding family members from potential challenges and risks they may encounter. These measures include sound financial planning, healthcare insurance, providing safe living environments, and promoting positive family communication. By implementing these strategies, families can be better prepared to face challenges and maintain their stability and happiness.

Family preventive measures are the key to stability and peace in its life. In an era filled with potential challenges and risks, these strategies become a vital necessity to safeguard the well-being and health of family members. Family preventive measures enhance the ability to tackle potential difficulties and maintain stability. In this context, we will explore the significance and effectiveness of these measures and how families can successfully implement them to ensure a safe and happy life for their members.

The Importance of Preventive Measures in the Family

1. Protecting Individual Health:

-

Early Healthcare: Promoting early medical check-ups and tests helps in the early detection of potential illnesses, increasing chances of recovery and reducing medical costs.

-

Healthy Diet: These measures include focusing on providing a balanced and nutrient-rich diet to enhance the family members' health.

-

Combatting Harmful Habits: The family should encourage its members to quit harmful behaviors such as smoking and excessive alcohol consumption to maintain their health.

2. Financial Stability:

-

Debt Management: These measures involve careful debt management and avoidance of excessive debts that may lead to financial problems.

-

Saving and Investment: The family must plan for saving and intelligently investing their money to ensure sustainable financial stability.

3. Communication and Support:

-

Enhancing Communication: This series of measures encourages building good communication and understanding among family members.

-

Providing Emotional Support: Family members can emotionally support each other during tough times and life challenges.

4. Planning for the Future:

-

Preparatory Planning: The family should establish a plan for its future, including educating children and financial retirement.

-

Emergency Preparedness: Future planning includes preparing an emergency plan to deal with unexpected situations.

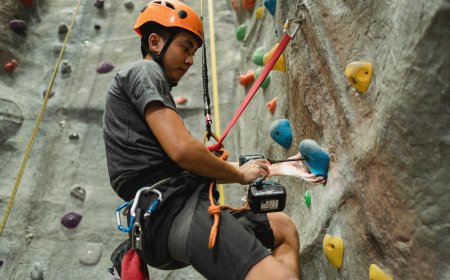

5. Enhancing Safety:

-

Safety Awareness: These measures involve increasing awareness of safety rules and preventive measures to avoid accidents.

-

Home Security: The family should take measures to secure their home and protect its members from risks.

In summary, preventive measures in the family play a crucial role in maintaining the health, stability, and peace in the lives of its members. By implementing these measures, the family can enhance its quality of life and reduce potential risks that it may face.

Establishing Healthcare Insurance: A Shield of Protection for the Family

1. Understanding Health Insurance:

-

Health Insurance Concept: A detailed explanation of the concept of health insurance and how it provides protection for family members.

-

Types of Health Insurance: An introduction to different types of health insurance, such as government health insurance and private health insurance.

2. Benefits and Coverage:

-

Health Insurance Benefits: A comprehensive explanation of the benefits that health insurance offers to families.

-

Extent of Coverage: Clarification of the extent of healthcare coverage family members can receive through health insurance.

3. Selection and Plans:

-

Choosing the Right Plan: Tips on how to select the most suitable insurance plan for the family's needs.

-

Insurance Costs: An explanation of how to calculate health insurance costs and how to budget for it.

4. Doctor Visits and Care Services:

-

Routine Doctor Visits: The importance of regular doctor visits to maintain family health.

-

Available Healthcare Services: An overview of available healthcare services through health insurance.

5. File Management and Claims:

-

Health Record Keeping: How to organize and store health records and related information.

-

Claims Processing: Guidance on how to file claims and deal with financial matters in case of emergencies.

6. Health Awareness:

-

Disease Awareness and Prevention: How to increase awareness of diseases and preventive measures to maintain family health.

-

Healthy Lifestyle: Tips on maintaining a healthy lifestyle and how the family can improve its living habits.

7. Health Insurance and Finances:

-

Health Insurance Costs: An explanation of the costs associated with health insurance and how to manage them.

-

Budgeting: Strategies for effectively budgeting for health insurance.

8. Health Insurance and Family:

-

Family Protection: How health insurance can protect the family from unexpected financial burdens resulting from illnesses or injuries.

-

Children's Coverage: How health insurance can provide protection for children and meet their healthcare needs.

9. Commitment and Renewal:

-

Health Insurance Commitment: The importance of committing to health insurance and renewing it regularly.

-

Improving Coverage: How to improve healthcare coverage and update plans when necessary.

10. Health Insurance Evaluation and More:

-

Health Insurance Evaluation: How to assess current health insurance and review plans and make changes as needed.

-

Additional Resources: Guidance on additional resources and information for the family about health insurance.

By implementing these measures, the family can secure the necessary health protection and financial stability for its members. It requires a good understanding of health insurance and careful planning to ensure the family is protected from healthcare risks.

Smart Financial Management: Enhancing Family Stability

1. Financial Situation Analysis:

-

Understanding Financial Situation: Evaluating the family's current financial situation and identifying strengths and weaknesses.

-

Expense Tracking: How to track monthly financial expenses and obligations.

2. Budgeting:

-

Creating a Budget: How to establish a monthly or annual budget that encompasses all expected expenses.

-

Importance of Saving: Educating the family on the importance of saving a portion of their income for the future.

3. Financial Goal Planning:

-

Setting Goals: How to set short-term and long-term financial goals to work towards.

-

Strategies for Achieving Goals: Developing strategies and an action plan to achieve financial goals.

4. Financial Guidance:

-

Providing Guidance: Educating family members on how to manage financial matters intelligently.

-

Smart Decision-Making: How to make smart financial decisions, such as signing contracts and investing money wisely.

5. Debt Management and Financial Settlement:

-

Managing Debt: How to deal with debt cautiously and develop a plan for its repayment.

-

Financial Settlement: Guidance on how to negotiate and settle financial matters when necessary.

6. Financial Emergencies and Savings:

-

Preparing for Tough Times: Developing a plan to deal with financial emergencies, such as job loss or unexpected medical expenses.

-

Building a Financial Reserve: How to create a financial reserve to protect the family from challenging financial situations.

7. Consultation with Financial Professionals:

-

Finding Financial Advisors: How to locate financial professionals for expert advice.

-

Personal Financial Consultations: The benefits of personalized financial consultations tailored to the family's needs.

8. Financial Education for Children:

-

Financial Education: How to teach children to manage financial matters responsibly.

-

Spending Guidance: Educating children on making sustainable financial decisions.

9. Financial Performance Evaluation:

-

Monitoring Performance: How to regularly evaluate financial performance and update strategies.

-

Improving Financial Situations: How to enhance financial situations over time.

10. Community Engagement and Giving Back:

-

Participation in Charitable Work: The family's role in supporting charitable activities and assisting others.

-

Contributing to the Community: How to promote community involvement and support positive initiatives.

By applying these measures, the family can achieve smart financial management that enhances stability and helps them reach their financial goals. These processes require careful planning and a solid understanding of smart money management.

Promoting Family Communication: The Key to Understanding and Dialogue

1. The Importance of Family Communication:

-

Fundamental Understanding: Explaining the fundamental importance of family communication in nurturing relationships and understanding individuals.

-

Comprehensive Concept: Providing a comprehensive definition of the concept of family communication.

2. Understanding Needs and Emotions:

-

Effective Listening: How to develop active listening skills to understand the needs and emotions of family members.

-

Expressing Feelings: The profound importance of openly discussing feelings and personal needs.

3. Family Dialogue:

-

Organizing Constructive Discussions: How to organize constructive and effective family discussions.

-

Establishing Rules and Respect: The importance of setting rules for discussions and practicing mutual respect.

4. Constructive Conflict Resolution:

-

Understanding Conflict: How to deeply understand conflicts and their roots.

-

Developing Solutions: Presenting constructive methods for resolving conflicts without escalation.

5. Strengthening Intergenerational Communication:

-

Communication with Children: How to strengthen family communication with children and understand their needs.

-

Communicating with Adolescents: Effective communication with teenagers, building trust.

6. Communication in Challenging Times:

-

Support During Crises: How to strengthen communication during challenging times and support family members.

-

Healthy Conversations: How to discuss difficult issues openly and address mental health.

7. Building Trust and Understanding:

-

Trust Building: How to build trust among family members through healthy communication.

-

Mutual Understanding: The profound importance of mutual understanding and acceptance of differences.

8. Preserving Memories and Staying Connected:

-

Effective Communication: How to preserve beautiful moments and maintain intergenerational communication.

-

Maintaining Family Bonds: The profound importance of communication in preserving family bonds.

9. Communication Technology and Social Media:

-

Utilizing Technology: How to make use of modern communication tools for family communication.

-

Preserving Privacy: The profound importance of preserving privacy while using communication tools.

10. Guidelines for Enhancing Communication:

-

Daily Practices: Daily tips for enhancing family communication.

-

Celebrating Family Meetings: How to celebrate special moments and promote family communication.

By implementing these measures, families can effectively enhance their communication, significantly contributing to better understanding and mutual understanding among its members. This requires deep consideration of the importance of communication and sustainable strategies for its improvement.

Providing a Safe Shelter: Safeguarding the Family Home

1. Home Security Assessment:

-

Comprehensive Review: How to assess home security and identify areas in need of improvement.

-

Professional Security Consultation: How to obtain professional security consultation to enhance home security.

2. Reinforcing Door and Window Security:

-

Enhancing Locks: How to upgrade door and window locks to prevent unauthorized entry.

-

Security Systems: Introducing security systems such as surveillance cameras and alarm systems.

3. Fire Prevention:

-

Fire Alarm Devices: How to install and maintain fire alarm devices in the home.

-

Developing an Escape Plan: How to create an escape plan in case of a fire.

4. Electrical and Appliance Safety:

-

Appliance Maintenance: How to safely maintain and use household appliances.

-

Safe Electricity Usage: Providing guidelines for the safe use of electricity to avoid accidents.

5. Theft and Burglary Prevention:

-

Home Security Systems: How to install security systems to deter theft and burglary.

-

Enhancing Neighborhood Awareness: How to foster communication with neighbors to increase home security.

6. Safe Storage of Hazardous Materials:

-

Hazardous Material Storage: How to safely store hazardous materials away from children.

-

Proper Disposal: How to safely dispose of hazardous materials no longer needed.

7. Natural Disaster Preparedness:

-

Disaster Preparedness: How to prepare for natural disasters such as earthquakes and hurricanes.

-

Evacuation Plan: Developing a family evacuation plan in case of natural disasters.

8. Home Healthcare:

-

Doctor Visits: How to receive home healthcare and follow-up with healthcare providers.

-

Safe Medication Storage: How to safely store medications and healthcare materials.

9. Regular Maintenance and Repairs:

-

Home Maintenance: How to care for regular home maintenance to prevent issues.

-

Executing Repairs: How to promptly execute necessary repairs.

10. Community Safety Awareness:

-

Safety Awareness: How to raise awareness about safety issues in the local community.

-

Collaboration with Local Authorities: How to collaborate with local authorities to increase safety in the area.

By implementing these measures, families can effectively enhance their home's security, helping to protect its members and property. This requires continuous attention to safety issues and the implementation of sustainable preventative measures.

Dealing with Financial Challenges in the Family

1. Financial Situation Assessment:

-

Understanding the Current Situation: How to assess the current financial situation of the family and identify sources of income and expenses.

-

Budget Preparation: How to create a monthly or yearly budget to control spending.

2. Setting Financial Goals:

-

Defining Goals: How to set short-term and long-term financial goals to work towards achieving them.

-

Goal Achievement Strategies: Developing strategies and an action plan to achieve financial goals.

3. Financial Counseling:

-

Providing Guidance: Educating family members on how to manage financial matters wisely.

-

Making Informed Decisions: How to make smart financial decisions such as signing contracts and investing money wisely.

4. Debt Management and Financial Settlement:

-

Debt Management: How to handle debts cautiously and create a plan to repay them.

-

Financial Settlement: Guidelines on how to negotiate and settle financial matters when necessary.

5. Dealing with Financial Emergencies and Building Reserves:

-

Preparing for Tough Times: How to handle financial emergencies such as job loss or unexpected medical expenses.

-

Building a Financial Reserve: How to create a financial reserve to protect the family from tough financial situations.

6. Consultation with Financial Professionals:

-

Finding Financial Advisors: How to locate financial professionals for expert advice.

-

Personal Financial Consultations: The benefits of personalized financial consultations tailored to the family's needs.

7. Financial Education for Children:

-

Financial Education: How to teach children responsible financial management.

-

Guidance in Spending: Educating children on making sustainable financial decisions.

8. Financial Performance Evaluation:

-

Monitoring Performance: How to regularly evaluate financial performance and adjust strategies as needed.

-

Adapting to Changes: How to adapt to changes in the financial situation and adjust goals.

9. Investment and Income Expansion:

-

Investment Opportunities: How to safely exploit investment opportunities and understand risks.

-

Increasing Income Sources: How to explore ways to increase income sources.

10. Working on Financial Motivation and Incentives:

-

Motivating Individuals and the Family: How to boost motivation to achieve financial goals.

-

Rewards and Celebrations: How to honor financial achievements and celebrate them.

By implementing these measures, families can successfully address financial challenges and enhance their financial stability. This requires a commitment to preventative measures and sound financial planning.

Enhancing Mental Health: Family Happiness

1. Understanding Mental Health:

-

The Importance of Mental Health: Understanding the significance of mental health and its impact on family life.

-

Indicators of Good Mental Health: How to recognize signs of good mental health in family members.

2. Enhancing Family Happiness:

-

Effective Communication: How to enhance effective communication among family members to build healthy relationships.

-

Quality Time: How to spend quality time with family members to strengthen bonds and happiness.

3. Managing Stress and Life Pressures:

-

Stress Control Strategies: How to manage stress and apply strategies for its control.

-

Emotional Resilience: How to build emotional resilience in family members to cope with life pressures.

4. Fostering Understanding and Respect:

-

Mutual Respect: How to promote mutual respect among family members.

-

Conflict Resolution: How to deal with conflicts constructively and find mutually agreeable solutions.

5. Self-Care and Mental Health:

-

Self-Care: How to manage personal mental health and practice self-care.

-

Mental Health Counseling: The benefits of seeking mental health counseling when needed.

6. Recreational Activities and Hobbies:

-

Family Activities: How to organize and participate in recreational activities as a family.

-

Developing Personal Hobbies: How to encourage family members to develop their personal hobbies.

7. Strengthening Social Support:

-

Building a Support Network: How to establish a strong social support network for family members.

-

Coping with Social and Family Shocks: How to effectively cope with social and family shocks.

8. Striving for Balance:

-

Balancing Work and Family Life: How to strike a balance between professional commitments and family time.

-

Relaxation and Renewal: How to take care of oneself and relax for renewed vigor.

9. Health Education:

-

Mental Health Awareness: How to promote awareness of mental and physical health issues.

-

Healthy Living: How to cultivate healthy lifestyle habits for individuals and the family.

10. Celebrating Achievements and Fostering Positivity:

-

Celebrating Accomplishments: How to celebrate personal and family achievements.

-

Spreading Positivity: How to promote confidence and positivity among family members.

By implementing these measures, families can enhance mental health and increase happiness in their lives. This requires a focus on preventative measures and the psychological well-being of family members.

Planning for the Future: Security for Family Members

1. Setting Future Goals:

-

Defining Personal and Family Goals: How to define personal and family goals for the future.

-

Directing Plans Toward Security: Developing strategies to safely achieve these goals.

2. Financial Management and Investment:

-

Creating a Family Budget: How to create a budget that helps achieve financial goals.

-

Investment Plans: How to identify smart investment opportunities to increase financial security.

3. Education and Training Planning:

-

Skills Enhancement: How to enhance the skills of family members through education and training.

-

Career Guidance: How to guide family members toward secure educational and career paths.

4. Insurance and Protection:

-

Health and Life Insurance: How to select appropriate insurance options for financial protection.

-

Emergency Planning: How to develop plans for dealing with financial emergencies and contingencies.

5. Retirement Planning:

-

Determining Retirement Needs: How to determine what is needed for a secure and comfortable retirement.

-

Retirement and Savings Plans: How to develop retirement plans to ensure financial security in old age.

6. Wills and Estate Planning:

-

Preparing Wills: How to prepare wills and documents to guide asset distribution clearly.

-

Estate Planning: How to plan the estate to ensure the future security of family members.

7. Financial Literacy and Awareness:

-

Building Financial Literacy: How to enhance the financial literacy of family members.

-

Educating Family Children: How to guide children in understanding financial matters and ensuring a secure future.

8. Mental and Social Well-being Planning:

-

Enhancing Mental Well-being: How to promote the mental well-being of family members.

-

Social Engagement: How to enhance social engagement and relationships.

9. Plan Review and Adaptation:

-

Regular Assessment: How to assess and adjust plans regularly in response to changes and needs.

-

Adapting to Challenges: How to adapt to financial challenges and developments.

10. Celebrating Achievements and Future Security:

-

Celebrating Accomplishments: How to celebrate financial and personal achievements.

-

Enhancing Security and Confidence: How to enhance financial security and confidence in the future.

By implementing these measures, families can achieve financial security and plan for a safe future for their members. This requires sustainable thinking and care for financial well-being and security.

Increasing Safety Awareness: Guarding Against Risks

1. Understanding Risks and Safety:

-

Defining Risks: How to define and understand the concept of risks.

-

Importance of Safety Awareness: Why families should be aware of the importance of safety.

2. Home Safety Awareness:

-

Household Safety: How to improve safety within the home.

-

Preventing Accidents: How to implement measures to prevent household accidents.

3. Personal Safety:

-

Personal Safety: How to maintain personal safety and health.

-

Health Awareness: How to identify personal health matters and deal with them.

4. Outdoor Safety Awareness:

-

Public Safety: How to safely behave in public places.

-

Preventing Natural Disasters: How to plan for protection against natural disasters.

5. Road Safety Awareness:

-

Road Safety: How to safely drive or walk on roads.

-

Awareness of Traffic Accidents: How to avoid and prevent traffic accidents.

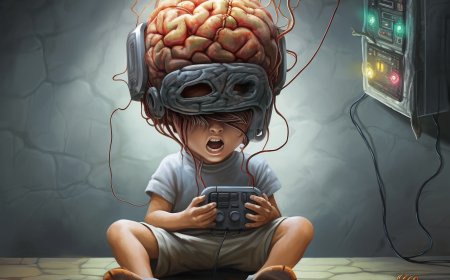

6. Internet Safety Awareness:

-

Online Safety: How to safely use the internet and protect personal data.

-

Preventing Online Fraud: How to recognize and avoid online fraud risks.

7. Substance Use and Addiction Awareness:

-

Preventing Substance Use: How to raise awareness of substance use risks.

-

Managing Addiction: How to deal with addiction problems and seek treatment.

8. Security Guidance and Precautions:

-

Emergency Plans: How to prepare emergency plans for various situations.

-

Precautions and Guidance: How to implement safety precautions.

9. Community Safety Awareness:

-

Community Involvement: How to participate in efforts to promote community safety.

-

Enhancing Social Safety: How to improve social safety and security.

10. Motivating Safety Awareness and Promoting Prevention:

-

Safety Awareness: How to encourage individuals to be aware of safety matters.

-

Enhancing Security and Confidence: How to enhance safety and confidence in facing risks.

By implementing these measures, families can promote safety awareness and prevent risks in their daily lives. This requires conscious thinking and working on raising awareness of potential risks and safe behaviors.

Family Sustainability: Building a Bright Future for the Family

1. Achieving Family Sustainability:

-

Defining Sustainability: What sustainability means in a family context and why it's essential.

-

The Significance of Sustainability: Why families should strive for sustainability in their lives.

2. Sustainable Financial Management:

-

Creating a Sustainable Budget: How to establish a family budget that promotes financial sustainability.

-

Smart Investment Choices: How to make investment decisions that contribute to financial sustainability.

3. Sustainable Education and Development:

-

Sustainable Education: How to promote ongoing education and skill development.

-

Sustainable Career Guidance: How to guide family members toward sustainable career paths.

4. Sustainable Health and Well-being:

-

Good Health and Well-being: How to maintain health and well-being sustainably.

-

Sustainable Nutrition and Fitness: How to practice sustainable nutrition and fitness.

5. Environmental Sustainability:

-

Environmental Sustainability: How to contribute to environmental protection and sustainability.

-

Sustainable Consumption: How to adopt sustainable consumption habits in daily life.

6. Sustainability in Communication and Relationships:

-

Sustainable Understanding: How to maintain sustainable communication and healthy relationships.

-

Constructive Conflict Resolution: How to deal with conflicts constructively and sustainably.

7. Achieving Sustainable Security:

-

Sustainable Financial Security: How to secure financial stability for the future sustainably.

-

Retirement and Legacy Planning: How to guide retirement planning and legacy arrangements sustainably.

8. Social and Community Sustainability:

-

Sustainable Community Involvement: How to participate in social activities sustainably.

-

Promoting Sustainability in the Community: How to achieve sustainable development within the community.

9. Sustainable Understanding and Collaboration:

-

Enhancing Sustainable Communication: How to enhance communication and understanding sustainably.

-

Sustainable Family Collaboration: How to promote collaboration and teamwork within the family.

10. Achieving Sustainability and Building a Bright Future:

-

Sustainability and Satisfaction: How to achieve overall sustainability and satisfaction.

-

Sustainability as a Lifestyle: How to embrace sustainability as a sustainable lifestyle.

By implementing these measures, families can build a sustainable and bright future for their members. This requires conscious thinking and working towards sustainability in various aspects of family life.

In conclusion

It can be said that family preventive measures are the foundation of its stability and happiness. These strategies provide families with security and readiness to face potential challenges that may arise in their life journey. They contribute to strengthening family bonds and preserving both physical and mental health. By understanding the importance of these measures and applying them wisely, families can protect themselves and ensure a more sustainable and happy future for their members. The power lies in preparation and prevention, and keeping the family remains a fundamental pillar for both the individual and society as a whole.

What's Your Reaction?