Achieving financial independence before retirement age

Achieving financial independence before retirement is an important goal that many individuals aspire to at various stages of their lives. This goal involves striking a financial balance that allows them to rely entirely on their personal income without the need for dependence on official retirement income. Achieving financial independence encompasses several elements, including increasing income from diverse sources, managing debts wisely, and making smart investment decisions. Financial independence may also involve starting a private business or taking advantage of freelance opportunities, contributing to achieving financial autonomy that enables individuals to freely shape their financial path and fulfill their goals without constant financial pressures.

Achieving financial independence before retirement is an ambitious goal that many aspire to in their financial journey. Financial independence means the ability to strike a financial balance that allows individuals to rely on their personal income and achieve financial autonomy without the need for complete dependence on official retirement income. Achieving this goal requires continuous effort and a smart financial strategy. By increasing income sources, improving debt management, and making thoughtful investment decisions, individuals can attain financial independence and freely shape their financial path. In this introduction, we will explore the significance of achieving financial independence before retirement and how it can positively impact life quality and future financial plans.

Strategies for Achieving Early Financial Independence

Achieving early financial independence is a compelling goal that requires strategic planning, disciplined execution, and a commitment to financial principles. This detailed exploration will delve into strategies that individuals can adopt to attain financial independence at an early stage in life.

1. Financial Education and Literacy:

- Develop a strong foundation of financial knowledge. Understand basic concepts such as budgeting, investing, and debt management.

- Continuous learning about personal finance empowers individuals to make informed decisions, a crucial aspect of achieving financial independence.

2. Set Clear Financial Goals:

- Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Having clear objectives provides a roadmap for financial planning and helps individuals stay focused on their path to financial independence.

3. Live Below Your Means:

- Adopt a frugal lifestyle and prioritize needs over wants.

- Save a significant portion of income by avoiding unnecessary expenses, allowing for more substantial contributions to savings and investments.

4. Debt Management:

- Minimize and eliminate high-interest debts as quickly as possible.

- Prioritize paying off debts strategically, starting with high-interest obligations to free up more resources for savings and investments.

5. Income Diversification:

- Explore multiple streams of income, such as side hustles, investments, or passive income sources.

- Diversifying income streams provides stability and accelerates the accumulation of wealth.

6. Strategic Investments:

- Invest in assets that align with long-term financial goals.

- Consider a diversified investment portfolio that includes stocks, bonds, real estate, and other suitable instruments to maximize returns.

7. Tax Optimization:

- Be mindful of tax implications and explore legal ways to minimize tax obligations.

- Utilize tax-advantaged accounts and strategies to optimize income and investment returns.

8. Emergency Fund:

- Establish and maintain an emergency fund to cover unexpected expenses.

- A robust emergency fund provides financial security and prevents the need to dip into long-term investments during unforeseen circumstances.

9. Continuous Monitoring and Adjustment:

- Regularly review financial goals, investment strategies, and overall financial plans.

- Adjust plans based on changes in income, expenses, and market conditions to ensure continued progress toward financial independence.

10. Live a Healthy Lifestyle:

- Prioritize physical and mental health to minimize healthcare expenses.

- A healthy lifestyle contributes to overall well-being and reduces the financial burden associated with medical costs.

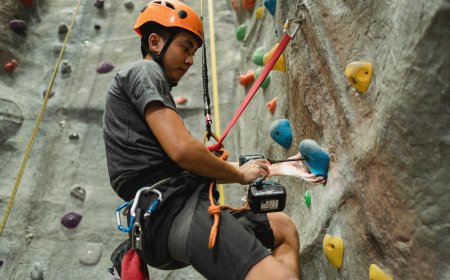

11. Entrepreneurship:

- Explore entrepreneurial ventures and business opportunities.

- Building a successful business can significantly contribute to wealth accumulation and expedite the journey to financial independence.

12. Realistic Retirement Planning:

- Develop a realistic and achievable retirement plan.

- Consider factors such as inflation, lifestyle preferences, and potential healthcare costs in retirement planning to ensure long-term financial sustainability.

13. Network and Learn from Others:

- Connect with individuals who have achieved early financial independence.

- Learning from the experiences of others can provide valuable insights and strategies for navigating the path to financial freedom.

14. Mindful Spending:

- Practice mindful spending by evaluating the value and necessity of purchases.

- Avoid unnecessary expenses and focus on allocating resources to activities and items that align with long-term financial goals.

15. Negotiate and Seek Opportunities:

- Negotiate for better terms on loans, services, and purchases.

- Actively seek opportunities for career advancement, higher-paying positions, or lucrative investment options to enhance financial prospects.

Achieving early financial independence is a multifaceted journey that requires a combination of financial discipline, strategic planning, and continuous adaptation. By cultivating good financial habits, making informed investment decisions, and prioritizing long-term goals, individuals can expedite their path to financial freedom and create a life that aligns with their values and aspirations. Regular self-assessment and adjustments to financial strategies are key to staying on course and achieving early financial independence.

The Importance of Financial Guidance on the Journey to Financial Independence

The journey to financial independence is a complex and multifaceted endeavor that often requires a combination of knowledge, discipline, and strategic planning. While individuals can certainly navigate this path on their own, the importance of financial guidance cannot be overstated. Seeking advice from financial experts, advisors, and mentors can provide invaluable insights, mitigate risks, and enhance the likelihood of achieving financial independence. This detailed exploration will delve into the various aspects of why financial guidance is crucial on the journey to financial independence.

1. Expertise in Complex Financial Matters:

- Financial professionals possess expertise in navigating complex financial matters, including investment strategies, tax planning, and risk management.

- Their knowledge helps individuals make informed decisions, optimize their financial portfolios, and avoid common pitfalls.

2. Customized Financial Planning:

- Financial advisors tailor their advice to individual circumstances, taking into account unique goals, risk tolerance, and financial situations.

- Customized financial planning ensures that strategies align with personal aspirations and are adaptable to changing life circumstances.

3. Risk Mitigation:

- Financial experts can assess and mitigate risks associated with investments, ensuring that individuals make decisions aligned with their risk tolerance.

- By identifying potential pitfalls and implementing risk management strategies, advisors help safeguard financial stability.

4. Optimizing Investment Returns:

- Professionals can provide insights into optimizing investment returns through diversified portfolios and strategic asset allocation.

- Maximizing returns while managing risks is crucial for building wealth and accelerating the journey to financial independence.

5. Tax Efficiency:

- Financial advisors are well-versed in tax laws and can devise strategies to minimize tax liabilities.

- Tax-efficient planning ensures that individuals retain a higher percentage of their income and investment returns.

6. Long-Term Financial Planning:

- Financial experts assist in developing comprehensive long-term financial plans that encompass retirement, estate planning, and legacy considerations.

- Strategic long-term planning ensures sustained financial well-being beyond the initial attainment of independence.

7. Behavioral Guidance:

- Financial professionals offer behavioral guidance to help individuals make rational and disciplined financial decisions.

- Emotional discipline is crucial in avoiding impulsive actions that could jeopardize financial goals.

8. Market Insights:

- Financial advisors stay abreast of market trends, economic conditions, and investment opportunities.

- Their insights help individuals navigate changing market landscapes and adjust strategies accordingly.

9. Access to Specialized Knowledge:

- Certain financial decisions, such as estate planning or complex investment structures, require specialized knowledge.

- Financial experts provide access to this specialized knowledge, ensuring that individuals make well-informed choices in every aspect of their financial journey.

10. Continuous Monitoring and Adjustments:

- Advisors continuously monitor financial plans and recommend adjustments based on changes in personal circumstances or market conditions.

- Regular reviews ensure that financial strategies remain aligned with goals and adaptable to evolving circumstances.

11. Educational Opportunities:

- Financial experts often provide educational opportunities, helping individuals enhance their financial literacy.

- Empowered with knowledge, individuals can actively participate in decision-making and better understand the implications of various financial choices.

12. Estate Planning and Legacy Building:

- Estate planning is a critical aspect of long-term financial independence.

- Financial guidance assists in structuring estates, minimizing tax implications, and building a legacy for future generations.

13. Access to Networks and Resources:

- Financial advisors often have extensive networks and access to resources that can benefit individuals on their financial journey.

- Whether connecting with legal experts, investment professionals, or other specialists, individuals gain access to a broader range of expertise.

14. Peace of Mind:

- Having professional guidance provides individuals with peace of mind, knowing that their financial affairs are in the hands of experienced and knowledgeable professionals.

- This peace of mind contributes to overall well-being and confidence in financial decisions.

The importance of financial guidance on the journey to financial independence cannot be overstated. From navigating complex financial landscapes to providing customized strategies, mitigating risks, and optimizing returns, financial experts play a crucial role in shaping a successful financial future. Individuals seeking financial independence can benefit significantly from the wisdom and insights of those with expertise in the intricacies of personal finance. The collaborative effort between individuals and financial professionals paves the way for a more informed, strategic, and successful pursuit of financial independence.

Developing Income Sources for Financial Independence

Developing diverse and sustainable income sources is a crucial aspect of achieving financial independence. Financial independence is often defined as the ability to cover one's living expenses and achieve personal goals without being reliant on traditional employment. To attain this level of financial autonomy, individuals must strategically cultivate multiple income streams. This comprehensive exploration will delve into the various strategies and considerations involved in developing income sources for financial independence.

1. Diversification of Income Streams:

- Relying on a single source of income, such as a full-time job, carries inherent risks. Economic downturns or unexpected job loss can significantly impact financial stability.

- Diversifying income streams involves creating multiple sources, such as side businesses, investments, freelance work, or passive income streams. This provides a more resilient financial foundation.

2. Entrepreneurship and Side Businesses:

- Starting a side business or engaging in entrepreneurship can be a powerful way to generate additional income.

- Identify skills, passions, or hobbies that can be monetized, and gradually build a business on the side. This can eventually evolve into a primary income source.

3. Investment Income:

- Investments, including stocks, bonds, real estate, and other assets, can generate passive income.

- Building a diversified investment portfolio allows individuals to benefit from various market opportunities and earn income through dividends, interest, or capital gains.

4. Real Estate Ventures:

- Real estate can serve as both an investment and a source of regular income.

- Rental properties, real estate crowdfunding, or property development can provide ongoing cash flow and contribute to long-term wealth.

5. Freelancing and Consulting:

- Leveraging specific skills or expertise through freelancing or consulting arrangements can create additional income streams.

- Freelancers and consultants often have the flexibility to work with multiple clients simultaneously, increasing their earning potential.

6. Passive Income Streams:

- Passive income requires upfront effort or investment but provides ongoing returns with minimal active involvement.

- Examples include royalties from intellectual property, affiliate marketing, or income from automated online businesses.

7. Creating Online Courses and Products:

- Sharing knowledge or skills through online courses, ebooks, or digital products can generate income.

- Platforms for selling digital products allow individuals to reach a global audience and monetize their expertise.

8. Building and Selling Businesses:

- Entrepreneurial individuals may build and sell businesses as a way to realize significant financial gains.

- Successfully identifying market opportunities, establishing a business, and selling it can contribute substantially to financial independence.

9. Network Marketing and Affiliate Programs:

- Engaging in network marketing or participating in affiliate programs can be a source of income.

- Individuals earn commissions by promoting and selling products or services through their networks.

10. Continuous Skill Development:

- Investing in continuous skill development enhances the ability to adapt to changing market demands and opens up new income opportunities.

- Staying relevant in a dynamic job market ensures a competitive edge in income generation.

11. Retirement Accounts and Savings:

- Building a robust retirement fund and savings account contributes to financial independence.

- Adequate savings provide a safety net and supplement income during unforeseen circumstances.

12. Risk Management and Contingency Planning:

- Developing income sources should be accompanied by risk management and contingency planning.

- Understanding potential risks and having contingency plans in place ensures financial stability during challenging times.

13. Budgeting and Expense Management:

- Effectively managing expenses allows individuals to save more and invest in income-generating opportunities.

- Budgeting ensures financial resources are allocated wisely, supporting both short-term needs and long-term goals.

Developing income sources for financial independence requires a proactive and diversified approach. It involves a combination of entrepreneurial endeavors, investments, passive income, and continuous skill development. By diversifying income streams, individuals can create a resilient financial portfolio that withstands economic fluctuations and provides the flexibility to pursue personal and financial goals. Ongoing monitoring, adaptation to market trends, and prudent financial management are essential components of this journey toward financial independence.

Smart Debt Management and Reducing Financial Obligations

Smart debt management is a critical aspect of maintaining financial health and achieving long-term financial goals. While not all debt is inherently bad, it's essential to approach borrowing strategically, keeping in mind the overall financial well-being. This detailed exploration will delve into the principles and strategies of smart debt management, focusing on reducing financial obligations responsibly.

1. Understanding Types of Debt:

- Good Debt: Some debts, like a mortgage for a home or a student loan for education, can be considered "good" debt as they contribute to long-term wealth or personal development.

- Bad Debt: High-interest debts, such as credit card balances for non-essential expenses, are often categorized as "bad" debt as they can quickly accumulate and become financially burdensome.

2. Creating a Comprehensive Debt Inventory:

- List all outstanding debts, including the type of debt, interest rates, and outstanding balances.

- Having a clear overview helps in prioritizing repayments and developing a targeted debt reduction strategy.

3. Prioritizing High-Interest Debts:

- Focus on repaying high-interest debts first, as they accumulate more interest over time.

- By prioritizing these debts, individuals can reduce the overall interest paid and expedite the debt reduction process.

4. Implementing the Debt Snowball or Debt Avalanche Method:

- Debt Snowball: Start by paying off the smallest debt first, then roll the money used for that debt into paying off the next smallest debt.

- Debt Avalanche: Prioritize debts based on interest rates, paying off the highest interest rate debts first.

5. Negotiating Interest Rates:

- Contact creditors to negotiate lower interest rates, especially if there's a good repayment history.

- Lower interest rates mean less money spent on interest, allowing for faster debt repayment.

6. Consolidating and Refinancing:

- Consolidate high-interest debts into a single, lower-interest loan if possible.

- Refinancing can provide more favorable terms, reducing monthly payments and overall interest paid.

7. Creating a Realistic Repayment Plan:

- Develop a realistic budget that allocates a portion of income to debt repayment.

- Consistent, manageable payments contribute to steady progress in reducing financial obligations.

8. Building an Emergency Fund:

- Establishing an emergency fund prevents reliance on credit for unexpected expenses.

- This fund acts as a financial buffer, reducing the need to accumulate more debt in times of crisis.

9. Avoiding Accumulation of New Debt:

- Develop disciplined spending habits and avoid accumulating new debt while repaying existing obligations.

- Consistent effort is crucial to breaking the cycle of debt accumulation.

10. Seeking Professional Financial Advice:

- Consult with financial advisors or credit counselors for personalized advice.

- Professionals can offer insights into effective debt management strategies tailored to individual financial situations.

11. Understanding the Impact on Credit Score:

- Recognize that debt management practices can affect credit scores.

- Timely payments and responsible debt reduction positively impact creditworthiness.

12. Exploring Debt Forgiveness Programs:

- Investigate potential debt forgiveness programs, especially for student loans.

- Some programs offer relief based on specific criteria such as income, employment, or public service.

Smart debt management involves a combination of strategic planning, prioritization, and disciplined financial habits. By understanding the types of debt, creating a comprehensive inventory, and implementing targeted repayment methods, individuals can reduce financial obligations responsibly. Consistent efforts, coupled with negotiations, refinancing, and building emergency funds, contribute to a sustainable and effective debt reduction strategy. Seeking professional advice when needed ensures that the approach aligns with individual financial goals and circumstances. Ultimately, smart debt management is a key element in achieving and maintaining financial stability.

The Impact of Smart Investments on Financial Independence

Smart investments play a pivotal role in achieving and maintaining financial independence. When individuals make informed, strategic decisions in allocating their capital, they set the stage for sustainable growth, wealth accumulation, and the ability to meet financial goals. This detailed exploration will delve into the impact of smart investments on the journey towards financial independence.

1. Capital Appreciation:

- Smart Allocation: Investing in assets with the potential for capital appreciation, such as stocks or real estate, can significantly increase wealth over time.

- Long-Term Growth: A well-thought-out investment portfolio can grow steadily, providing a source of wealth that contributes to financial independence.

2. Income Generation:

- Diversification: Smart investments often include a diversified portfolio that generates income through dividends, interest, or rental payments.

- Passive Income: Establishing streams of passive income from investments reduces reliance on active work income, fostering financial independence.

3. Risk Mitigation:

- Diversified Portfolio: Properly diversified investments can mitigate risks associated with market fluctuations.

- Asset Allocation: Strategic asset allocation helps balance risk and return, safeguarding the overall portfolio from significant losses.

4. Tax Efficiency:

- Tax-Advantaged Accounts: Utilizing tax-advantaged investment accounts, such as IRAs or 401(k)s, enhances the efficiency of wealth accumulation.

- Strategic Tax Planning: Smart investors consider tax implications, optimizing strategies to minimize tax burdens and maximize returns.

5. Informed Decision-Making:

- Continuous Learning: Informed investors stay abreast of market trends, economic conditions, and new investment opportunities.

- Analytical Approach: Continuous learning sharpens analytical skills, allowing for informed decisions that align with financial goals.

6. Accelerating Wealth Accumulation:

- Compounding Returns: Smart investments harness the power of compounding, allowing returns to generate additional returns over time.

- Regular Contributions: Consistent contributions to investment accounts amplify the compounding effect, accelerating wealth accumulation.

7. Liquidity and Flexibility:

- Diverse Asset Classes: A diversified investment portfolio provides liquidity and flexibility.

- Adaptability: In times of need or opportunity, liquid assets offer the flexibility to access funds without disrupting the overall financial strategy.

8. Estate Planning and Legacy Building:

- Wealth Transfer: Smart investments contribute to building a substantial estate that can be transferred to future generations.

- Legacy Impact: Wealth generated through strategic investments can have a lasting impact on family legacies and financial well-being.

9. Financial Independence as a Goal:

- Clear Objectives: Smart investors align their investment strategies with specific financial independence goals.

- Regular Review: Regularly assessing progress towards financial independence allows for adjustments and refinements to the investment plan.

10. Psychological Impact:

- Confidence and Peace of Mind: Successful investments boost confidence and provide peace of mind, essential components of financial independence.

- Reduced Financial Stress: A well-performing investment portfolio contributes to reduced financial stress and anxiety.

Smart investments are a cornerstone of financial independence, impacting wealth accumulation, risk management, and the ability to generate income. Through strategic decision-making, continuous learning, and a diversified approach, individuals can navigate the dynamic landscape of financial markets and build a robust foundation for their financial future. The impact of smart investments extends beyond personal wealth, influencing legacy-building and the realization of financial goals. By embracing informed and disciplined investment practices, individuals can attain and sustain financial independence, gaining the flexibility and security needed to live life on their terms.

Enhancing Financial Planning Skills for Sustainable Goals

Enhancing financial planning skills is crucial for achieving sustainable financial goals. Effective financial planning involves creating a roadmap to manage income, expenses, investments, and savings in a way that aligns with one's long-term objectives. This comprehensive exploration will delve into the key aspects of enhancing financial planning skills to ensure the attainment of sustainable goals.

1. Understanding Financial Goals:

- Clarity and Specificity: Clearly define and specify financial goals, whether they involve homeownership, education, retirement, or other milestones.

- Prioritization: Prioritize goals based on urgency and importance, creating a hierarchy for effective planning.

2. Budgeting and Expense Tracking:

- Detailed Budget: Develop a detailed budget that includes all sources of income and categorizes expenses.

- Regular Tracking: Consistently track expenses to identify areas for potential savings and ensure adherence to the budget.

3. Emergency Fund Establishment:

- Financial Safety Net: Establish an emergency fund to cover unexpected expenses and protect against financial setbacks.

- Optimal Size: Aim for an emergency fund that can cover three to six months' worth of living expenses.

4. Debt Management Strategies:

- Debt Assessment: Assess and categorize existing debts, prioritizing high-interest debts for faster repayment.

- Strategic Repayment: Implement a strategic debt repayment plan, focusing on high-interest debts while maintaining minimum payments on others.

5. Investment Education:

- Continuous Learning: Stay informed about various investment options, risk profiles, and potential returns.

- Risk Tolerance: Understand personal risk tolerance and align investments accordingly to achieve a balanced portfolio.

6. Tax Planning:

- Strategic Approach: Plan investments and financial decisions with tax implications in mind.

- Utilize Tax-Advantaged Accounts: Leverage tax-advantaged accounts to optimize tax efficiency and enhance overall returns.

7. Savings Automation:

- Automatic Transfers: Set up automatic transfers to savings and investment accounts.

- Consistent Contributions: Automating savings ensures consistency and reduces the likelihood of missing contributions.

8. Regular Financial Checkups:

- Periodic Reviews: Conduct regular reviews of financial goals, budget, and investment portfolio.

- Adjustment and Realignment: Adjust plans based on changes in income, expenses, and financial objectives.

9. Insurance Coverage:

- Comprehensive Assessment: Assess insurance needs for health, life, property, and other relevant areas.

- Regular Updates: Regularly review and update insurance coverage to align with changing circumstances.

10. Education and Professional Advice:

- Formal Education: Invest in financial literacy through courses, workshops, or professional certifications.

- Seeking Professional Guidance: Consider consulting with financial advisors for personalized advice tailored to individual circumstances.

11. Long-Term Vision and Adaptability:

- Goal Reevaluation: Periodically reevaluate long-term financial goals and adjust them based on life changes.

- Adapt to Circumstances: Remain adaptable to economic changes, market fluctuations, and personal circumstances.

Enhancing financial planning skills is an ongoing process that involves a combination of education, discipline, and strategic decision-making. By understanding and prioritizing financial goals, managing expenses effectively, and staying informed about investment opportunities, individuals can build a sustainable financial plan. Regular reviews and adjustments, along with a commitment to continuous learning, ensure that financial planning remains dynamic and aligned with changing life circumstances. Ultimately, the goal is to achieve sustainable financial success and the ability to meet long-term objectives with confidence and resilience.

Providing Effective Ways for Saving and Sustainable Investment

Providing effective ways for saving and sustainable investment is instrumental in promoting financial well-being and long-term wealth accumulation. This comprehensive exploration will delve into key strategies and practices to encourage saving and sustainable investment, fostering financial stability and resilience.

1. Establishing Clear Saving Goals:

- Define Objectives: Clearly define short-term and long-term saving goals.

- Quantify Targets: Specify the amount and timeline for each saving goal.

2. Budgeting and Expense Management:

- Create a Detailed Budget: Develop a comprehensive budget to track income and categorize expenses.

- Identify Saving Opportunities: Analyze spending patterns to identify areas for potential savings.

3. Emergency Fund Building:

- Prioritize Emergency Fund: Allocate a portion of savings to build and maintain an emergency fund.

- Consistent Contributions: Make regular contributions to the emergency fund for financial security.

4. Utilize Tax-Advantaged Accounts:

- Explore Options: Investigate tax-advantaged accounts such as IRAs and 401(k)s.

- Maximize Contributions: Contribute the maximum allowed to benefit from tax advantages.

5. Explore Sustainable Investments:

- Research Environmentally Responsible Options: Consider investments that align with sustainable and ethical practices.

- Diversify Portfolio: Include sustainable funds or green investments for a diversified and responsible portfolio.

6. Automate Savings:

- Set Up Automatic Transfers: Schedule automatic transfers to savings or investment accounts.

- Consistency is Key: Automating savings ensures consistency and reduces the temptation to spend impulsively.

7. Educate on Investment Options:

- Financial Literacy: Educate individuals on various investment options and their risk-return profiles.

- Empower Decision-Making: Informed investors are more likely to make sustainable and profitable investment choices.

8. Encourage Sustainable Practices:

- Corporate Social Responsibility (CSR): Invest in companies with strong CSR practices.

- Support Sustainable Industries: Consider supporting industries that align with environmental and social responsibility.

9. Professional Financial Advice:

- Consult Financial Advisors: Seek guidance from financial professionals for personalized advice.

- Optimize Investment Strategy: Financial advisors can assist in optimizing investment strategies based on individual goals and risk tolerance.

10. Regular Portfolio Review:

- Periodic Evaluation: Conduct regular reviews of investment portfolios.

- Rebalance as Needed: Adjust the portfolio allocation based on market conditions and changing financial objectives.

11. Promote Long-Term Investment Perspective:

- Educate on Compound Growth: Emphasize the power of compounding for long-term wealth accumulation.

- Discourage Short-Term Thinking: Encourage investors to resist impulsive decisions driven by short-term market fluctuations.

12. Community and Peer Support:

- Group Saving Initiatives: Encourage community or peer-based saving initiatives.

- Shared Learning: Facilitate knowledge-sharing on effective saving and sustainable investment practices.

Providing effective ways for saving and sustainable investment involves a multifaceted approach, encompassing clear goal-setting, responsible budgeting, and education on sustainable investment options. By promoting a long-term perspective, encouraging consistent saving habits, and leveraging professional financial advice, individuals can build a robust financial foundation while contributing to sustainable practices. This holistic approach not only fosters personal financial growth but also aligns with broader environmental and social considerations, creating a positive impact on both individual wealth and the world at large.

The Role of Continuous Learning in the Financial Independence Journey

Continuous learning is a fundamental and dynamic aspect of achieving and sustaining financial independence. In the ever-evolving landscape of personal finance, staying informed, acquiring new skills, and adapting to changes are crucial elements for success. This detailed exploration delves into the significance of continuous learning in the financial independence journey and how it empowers individuals to navigate challenges, make informed decisions, and build a resilient financial future.

1. Knowledge Empowers Decision-Making:

- Analytical Skills: Continuous learning sharpens analytical skills, enabling individuals to critically assess financial situations.

- Informed Choices: Well-informed individuals can make sound financial decisions, aligning actions with long-term goals.

2. Evolving Financial Landscape:

- Market Dynamics: Continuous learning helps individuals understand changes in market conditions, economic trends, and investment opportunities.

- Adaptability: Those who continuously learn are better equipped to adapt strategies to navigate evolving financial landscapes.

3. Financial Literacy:

- Understanding Instruments: Continuous learning enhances financial literacy, ensuring a better understanding of various financial instruments.

- Risk Mitigation: Financially literate individuals are more capable of identifying and mitigating potential risks.

4. Technological Advancements:

- Digital Tools: Continuous learning includes staying abreast of technological advancements in financial tools and platforms.

- Efficiency: Utilizing modern tools enhances financial management efficiency and accessibility.

5. Investment Strategies and Opportunities:

- Diversification Techniques: Continuous learning provides insights into advanced investment strategies, including portfolio diversification.

- Identifying Opportunities: Those who invest time in learning can identify and capitalize on emerging investment opportunities.

6. Financial Planning Expertise:

- Goal Setting: Continuous learning helps in setting realistic financial goals and developing effective plans to achieve them.

- Adaptation: Ongoing education allows individuals to adapt financial plans to changing circumstances and goals.

7. Risk Management:

- Identifying Risks: Continuous learning enhances the ability to identify and assess various financial risks.

- Mitigating Strategies: Knowledgeable individuals can implement effective strategies to mitigate potential financial setbacks.

8. Networking and Community Building:

- Knowledge Sharing: Continuous learners often engage in networking and knowledge-sharing communities.

- Collective Wisdom: Learning from others' experiences contributes to a collective wisdom that enriches individual financial knowledge.

9. Career and Income Growth:

- Professional Development: Continuous learning contributes to professional development, potentially leading to career advancement.

- Income Diversification: Enhanced skills may open doors to new income streams and opportunities.

10. Financial Confidence:

- Informed Decision-Making: Continuous learners are more confident in making financial decisions.

- Reduced Anxiety: Confidence stemming from knowledge reduces financial anxiety and stress.

11. Regulatory and Economic Understanding:

- Compliance: Continuous learning ensures awareness of changing financial regulations and compliance requirements.

- Economic Insights: Understanding economic trends aids in making strategic financial decisions.

12. Future Planning and Legacy Building:

- Generational Wealth: Continuous learning contributes to effective wealth management and legacy building.

- Sustainable Financial Future: Individuals can plan for future generations with a strong foundation of financial knowledge.

Continuous learning is an indispensable tool on the journey to financial independence. It equips individuals with the knowledge and skills needed to navigate a complex financial landscape, make informed decisions, and adapt to changing circumstances. Whether through formal education, self-directed learning, or networking with financial communities, the commitment to continuous learning is an investment in long-term financial success. As the financial world evolves, those who embrace continuous learning are better positioned to achieve and sustain financial independence while confidently pursuing their financial goals.

Building a Strong Investment Portfolio to Control Financial Future

Building a robust investment portfolio is a strategic and essential step in taking control of your financial future. A well-crafted portfolio not only provides potential for wealth accumulation but also serves as a tool for managing risk and achieving financial goals. This detailed exploration will guide you through the key components and principles involved in building a strong investment portfolio that empowers you to control your financial destiny.

1. Define Your Financial Goals:

- Short-Term and Long-Term Objectives: Clearly define your financial goals, including both short-term needs and long-term aspirations.

- Risk Tolerance: Assess your risk tolerance to align investment strategies with your comfort level.

2. Understand Investment Instruments:

- Diversification: Familiarize yourself with various asset classes such as stocks, bonds, real estate, and alternative investments.

- Risk-Return Tradeoff: Understand the relationship between risk and return associated with different investment instruments.

3. Establish a Realistic Time Horizon:

- Short-Term vs. Long-Term Investments: Determine your investment time horizon, distinguishing between short-term and long-term investments.

- Compounding Benefits: Leverage the power of compounding by focusing on long-term investments for wealth accumulation.

4. Asset Allocation Strategies:

- Strategic Asset Allocation: Develop a strategic asset allocation plan based on your financial goals and risk tolerance.

- Rebalancing: Periodically rebalance your portfolio to maintain the desired asset allocation and adapt to changing market conditions.

5. Diversification Techniques:

- Across Asset Classes: Diversify your portfolio across different asset classes to spread risk.

- Within Asset Classes: Diversify within asset classes by investing in various securities or industries to mitigate specific risks.

6. Risk Management:

- Risk Assessment: Identify and assess the risks associated with your investment portfolio.

- Risk Mitigation Strategies: Implement risk mitigation strategies, such as diversification and asset allocation adjustments.

7. Regular Portfolio Monitoring:

- Performance Evaluation: Regularly monitor the performance of your investments against your financial goals.

- Market Conditions: Stay informed about market conditions and global economic trends affecting your portfolio.

8. Investment Research and Due Diligence:

- Thorough Analysis: Conduct thorough research before making investment decisions.

- Professional Advice: Seek professional advice or leverage expert analysis to make informed choices.

9. Consider Tax Implications:

- Tax-Efficient Strategies: Explore tax-efficient investment strategies to maximize returns.

- Long-Term Tax Planning: Consider the tax implications of holding investments over the long term.

10. Stay Informed and Adaptive:

- Economic Awareness: Stay informed about economic indicators, geopolitical events, and market trends.

- Adaptability: Be adaptive to changes in market conditions and adjust your portfolio accordingly.

11. Emergency Fund and Liquidity:

- Emergency Fund: Maintain a separate emergency fund for unexpected expenses to avoid liquidating investments during emergencies.

- Liquidity Planning: Ensure a balance between long-term investments and maintaining liquidity for short-term needs.

12. Reinvesting Profits:

- Compound Growth: Consider reinvesting profits and dividends to take advantage of compound growth.

- Long-Term Wealth Building: Reinvesting can contribute significantly to long-term wealth-building.

Building a strong investment portfolio is a dynamic and ongoing process that requires careful planning, informed decision-making, and adaptability to changing circumstances. By aligning your investments with clear financial goals, diversifying strategically, and staying vigilant in monitoring and adjusting your portfolio, you can take control of your financial future. Remember that each individual's financial situation is unique, and seeking professional advice can provide personalized insights that enhance your portfolio's strength and resilience over time.

Balancing the Present and Future

Achieving financial independence is a journey that requires a delicate balance between current financial needs and future aspirations. It involves strategic planning, disciplined saving, and prudent investment to secure both short-term stability and long-term prosperity. This detailed exploration delves into effective strategies for balancing the present and future, empowering individuals to navigate their financial independence journey successfully.

1. Establish Clear Financial Goals:

- Short-Term and Long-Term Objectives: Clearly define your financial goals, distinguishing between short-term needs (e.g., emergency fund, debt repayment) and long-term aspirations (e.g., retirement, wealth accumulation).

- Prioritize Goals: Rank your goals based on urgency and importance, creating a roadmap for financial planning.

2. Develop a Realistic Budget:

- Income and Expenses: Create a detailed budget outlining your income sources and monthly expenses.

- Emergency Fund: Allocate a portion of your budget to build and maintain an emergency fund for unexpected expenses.

3. Prioritize Debt Management:

- Debt Repayment Plan: Develop a systematic plan to pay off high-interest debts.

- Interest Rate Evaluation: Prioritize debts with higher interest rates to minimize long-term interest payments.

4. Build a Strong Foundation:

- Emergency Fund: Ensure the emergency fund covers three to six months' worth of living expenses.

- Insurance Coverage: Evaluate and secure appropriate insurance coverage to protect against unexpected events.

5. Strategic Savings:

- Automated Savings: Set up automatic transfers to savings accounts to ensure consistent contributions.

- Allocate for Goals: Allocate savings for specific goals, such as homeownership or education.

6. Investment for Long-Term Growth:

- Diversified Portfolio: Invest in a diversified portfolio to balance risk and return.

- Retirement Accounts: Contribute regularly to retirement accounts for long-term wealth accumulation.

7. Regularly Review and Adjust:

- Financial Checkpoints: Establish regular intervals to review your financial plan and adjust as needed.

- Life Changes: Update your plan in response to significant life events like marriage, children, or career changes.

8. Emergency Fund Maintenance:

- Replenishment: Prioritize replenishing your emergency fund after utilizing it for unexpected expenses.

- Adaptability: Ensure your financial plan is adaptable to unexpected changes in income or expenses.

9. Lifestyle Inflation Awareness:

- Savings Prioritization: Resist the temptation of increasing spending with an increase in income.

- Investment Focus: Channel additional income towards savings and investments rather than lifestyle inflation.

10. Continual Education and Awareness:

- Financial Literacy: Continuously educate yourself on personal finance, investment strategies, and economic trends.

- Empowerment: Informed decision-making is empowered decision-making. Stay aware and engaged in your financial journey.

11. Professional Financial Guidance:

- Financial Advisor Consultation: Seek advice from financial professionals to optimize your financial strategy.

- Long-Term Planning: Collaborate with experts for long-term financial planning and wealth preservation.

12. Enjoying the Present Responsibly:

- Balanced Living: Strive for a balanced lifestyle that includes enjoyment of the present without compromising future goals.

- Mindful Spending: Practice mindful spending, aligning expenses with values and long-term priorities.

Balancing the present and future is a dynamic process that requires thoughtful planning, disciplined execution, and adaptability. By establishing clear goals, managing finances strategically, and investing with a long-term perspective, individuals can navigate the complexities of financial independence successfully. Regular reviews, adjustments, and a commitment to continuous learning contribute to a balanced and resilient financial plan that ensures both present stability and future prosperity. Remember, achieving financial independence is not just a destination but an ongoing journey that evolves with your life circumstances and goals.

In conclusion

achieving financial independence before retirement emerges as a significant financial accomplishment that can bring about a profound transformation in individuals' lives. Through continuous effort and strategic thinking, individuals can attain a state where they can rely entirely on their own income sources, achieving financial freedom. Controlling financial matters and making sound decisions in investments and debt management wisely create a balance that enables individuals to successfully chart their financial path. The essence of success in this challenge lies in the commitment to continuous learning and enhancing financial competencies. Thus, achieving financial independence before retirement shows that the path to financial freedom may be filled with challenges, but it opens doors to a more stable and comfortable financial life.

Sources

What's Your Reaction?